Open Enrollment Season will begin soon, so you will need to make some choices regarding your employee benefits — and these choices can have a big impact on your financial situation. Depending on your employer, your benefits package may include various types of insurance, plus access to a 401(k) or similar retirement plan. Here are some suggestions for getting the most out of these benefits:

- Health insurance – Companies regularly change plans and providers, so the coverage and premiums you had last year may not be the same this year. In any case, look at all aspects of your coverage options –premiums, deductibles, co-pays and total out-of-pocket limits. A lower premium may seem attractive, but you could end up paying even more if the coverage is not as good. So, choose wisely.

- Life insurance – You may want to take whatever life insurance your employer offers, but it still might not be enough. To determine how much life insurance you need, consider a variety of factors – your age, income, family size, spouse’s income, and so on. If your employer’s coverage is insufficient, you may want to supplement it with a separate policy.

- Disability insurance – This could be a valuable employee benefit – but, as is the case with life insurance, your employer’s disability coverage may not be enough for your needs, especially if you’d like to protect yourself against an illness or injury that could sideline you from work for a long time. Consequently, you might want to consider purchasing your own disability policy.

You may also want to examine your retirement plan. You may be allowed to change your 401(k) throughout the year, but you’ve got a particularly good opportunity to do so during open enrollment. So look at your contribution level. Are you putting in as much as you can afford? At a minimum, invest enough to earn your employer’s matching contribution, if one is offered. And increase your own contributions whenever you get a raise. As far as your investment choices, you’ll want to spread your dollars among the different investments within your 401(k) in a way that reflects your risk tolerance and time horizon. During the early stages of your career, you can probably afford to invest more in growth-oriented accounts. These will fluctuate more in value, but you have time to overcome the downturns. When you’re nearing retirement, you may want to shift some of your assets into more conservative vehicles – but even at this point, you still need some growth opportunities. After all, you may spend two or three decades in retirement, so you’ll need to draw on as many resources as possible.

Open enrollment isn’t just a time to fill out a bunch of pa-pers. It’s also a chance to recon-sider – and maybe even upgrade – many areas of your financial outlook.

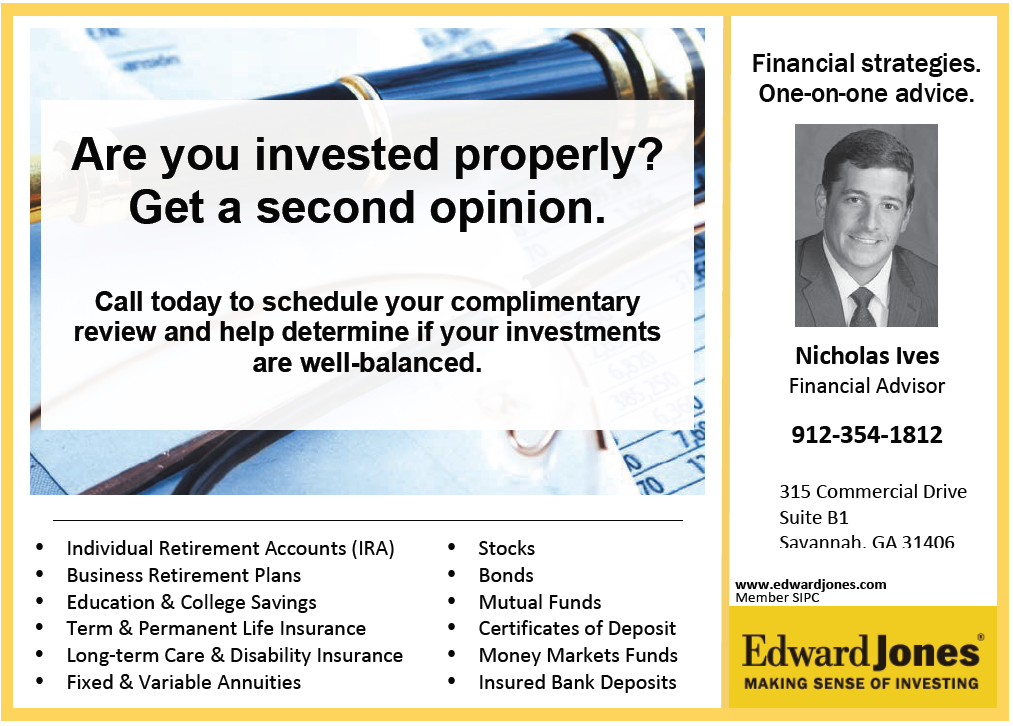

Provided by Nicholas Ives, Financial Advisor with Edward Jones. You can reach him at 912-354-1812.